the Creative Commons Attribution 4.0 License.

the Creative Commons Attribution 4.0 License.

Europe's adaptation to the energy crisis: reshaped gas supply–transmission–consumption structures and driving factors from 2022 to 2024

Chuanlong Zhou

Biqing Zhu

Antoine Halff

Steven J. Davis

Simon Bowring

Simon Ben Arous

Philippe Ciais

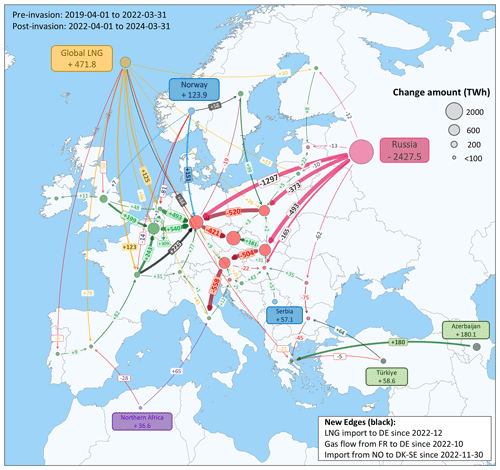

The 2022 invasion of Ukraine by Russia triggered a significant energy crisis in the EU27 (27 EU member countries) and UK (hereafter EU27&UK), leading to profound changes in their natural gas supply, transmission, and consumption dynamics. To analyze those pattern shifts, we first update our natural gas supply dataset, EUGasSC, with daily country- and sector-specific supply sources. We then provide a newly constructed daily intra-EU (European Union) natural gas transmission dataset, EUGasNet, with specified supply sources utilizing the ENTSOG (European Network of Transmission System Operators for Gas) and EUGasSC data. To further understand the economic and climatic impacts, we finally developed EUGasImpact, a daily dataset with sector-specific driving factors of consumption changes based on change attribution models using multiple open datasets. Those datasets are available on the Zenodo platform: https://doi.org/10.5281/zenodo.11175364 (Zhou et al., 2024). On the supply side, Russian gas supply to the EU27&UK was cut by 87.8 % (976.8 TW h per winter) during the post-invasion winters compared to the previous winters. Liquefied natural gas (LNG) imports became the largest gas supply source, rising from 20.7 % to 37.5 % of the total gas supply. Our intra-EU gas transmission analysis showed that the gas transmission network was adjusted to mitigate the large gas shortfalls in Germany and distribute LNG arrivals. Total gas consumption fell by 19.0 %, which was driven by (1) consumer behavioral changes in household heating (contributed to 29 % of the total reduction; the following numbers are also percentage contributions to the total reduction); (2) drops in industrial production (25 %); (3) heating drops due to the warmer winter temperatures (11 %); (4) shifts towards renewable electricity including wind, solar, and hydro (10 %); (5) a decline in gas-powered electricity generation (9 %); (6) adoption of energy-efficient heat pumps for industrial gas heating (4 %); (7) shifts towards non-renewable electricity including coal, oil, and nuclear (1 %); and (8) other unmodeled factors (11 %). We evaluated the benefits and costs associated with these pattern changes and discussed whether these changes would potentially lead to long-term structural changes in the EU energy dynamics. Our datasets and these insights can provide valuable perspectives for understanding the consequences of this energy crisis and the challenges to future energy security in the EU.

- Article

(6356 KB) - Full-text XML

- Companion paper

-

Supplement

(4577 KB) - BibTeX

- EndNote

The European Union (EU) faced an energy crisis triggered by the Russian invasion of Ukraine in 2022, which led to a sudden halt of natural gas supplies from Russia, the EU's largest gas supplier (Kardaś, 2023). In the year prior, 2021, Russia exported 155×109 m3 of natural gas (1.6×103 TW h), accounting for 45 % of the total EU gas imports (Eurostat, 2023a). The subsequent winters of this crisis presented crucial tests regarding the EU's ability to manage the disruption in Russian pipeline gas imports (Prince, 2023), especially considering the high heating demand in the cold seasons and the unexpected energy supply shortfalls (Zhou et al., 2023).

Prior studies have suggested multiple strategies to mitigate the energy crisis: (1) on the supply side, increasing gas imports from alternative suppliers, including additional imports from liquefied natural gas (LNG) and existing pipelines from northern Africa and the Middle East (McWilliams et al., 2023) (Castellano and Varela, 2023); (2) in terms of gas transmission, enhancing the intra-EU gas redistribution to balance the supply and demand among member states (Zhou et al., 2023); (3) on the consumption side, reducing gas demand, such as energy conservation, scaling down industrial production (IEA, 2023a; Zeniewski et al., 2023); and (4) regarding the energy structure, diversifying energy sources from gas, for instance, increasing the number of heat pumps, and switching to non-gas-powered electricity (Kardaś, 2023; Hockenos, 2023). However, there is a pressing need for detailed, high-resolution data to quantify the significance of those pathways in structural supply–transmission–consumption pattern changes and their economic and climatic impacts after the energy crisis. Additionally, quantitative assessment of intra-EU gas redirection in mitigating the crisis remains unclear, particularly because there were transmission “bottlenecks” in the intra-EU gas transmission net (Zhou et al., 2023; ENTSOG, 2020).

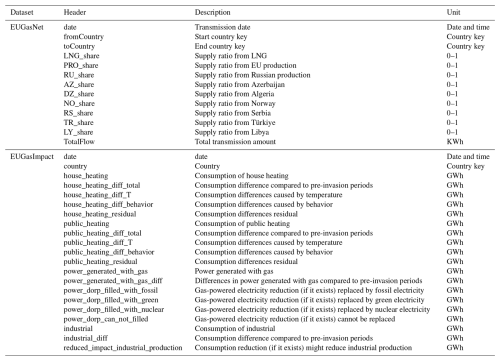

To address these needs, we developed comprehensive respective datasets for supply, transmission, and consumption at a daily resolution. On the supply side, we updated our EU natural gas dataset, EUGasSC (Zhou et al., 2023), which provides the country- and sector-specific gas supply patterns. For analyzing intra-EU gas redirection, we provide a newly constructed intra-EU gas transmission net dataset, EUGasNet, utilizing the ENTSOG (European Network of Transmission System Operators for Gas; ENTSOG, 2023) and EUGasSC data. To quantify the driving factors in the heating, power, and industrial sectors, we developed EUGasImpact using sector-specific change attribution models and multiple open datasets, thereby enabling the factor analysis and impact analysis of consumption changes across these sectors.

For the heating sector, we differentiated the consumption changes with the contribution of consumers' behavioral changes and anomalously warm winter temperatures (Abnett, 2023) based on a behavior–climate attribution model utilizing temperature–consumption curves (Zhou et al., 2023) and ERA5-Land temperature data (Hersbach et al., 2023). For the power sector, we assessed whether the consumption reduction in gas-powered electricity generation could be offset by the increments of electricity generation from alternative energy sources. This evaluation was conducted through an explainable-reduction attribution model with day-to-day change comparisons, utilizing both gas consumption and electricity generation data from the Carbon Monitor power dataset (Zhu et al., 2023). For the industrial sector, we assume that the consumption reduction due to the substitution of gas heating with electrically powered heat pumps is unlikely to lead to declines in industrial production (Castellano and Varela, 2023). A similar day-to-day change comparison approach is performed to assess whether the industrial consumption reduction could be explained by the increments of total electricity generation with a gas-to-electricity conversion efficiency.

We provide three datasets, EUGasSC, EUGasNet, and EUGasImpact, which contribute daily gas supply, transmission, and consumption dynamics with country- and sector-specific data. Using these datasets, we conducted comprehensive analyses of how EU states adapted to the energy crisis triggered by the invasion. The EUGasSC dataset illustrates how LNG imports replaced Russian pipeline imports and became the largest gas supply source to the EU. With EUGasNet, we found that the intra-EU gas transmission network shows enhanced “redirection” flows towards the western states, especially to Germany, which faced the most acute gas shortage. According to EUGasImpact, we quantified the contributions of driving factors to the significant net gas consumption reduction during the post-invasion winters, such as heating reduction, energy structure shifting, structural dependency reduction in gas use, and declines in electricity generation and industrial production. We further discussed the economic and climatic consequences of those shifts found from the three datasets, as well as whether those facets would lead to structural transformations in long-term energy security within the EU regions, regarding the uncertainties associated with the global LNG market, the intra-EU transmission “bottleneck” in the EU gas network, the potential impact to residential living costs, and the ongoing transition towards greener energy sources.

2.1 Data collection

The workflow of this study is shown in Fig. 1. On the supply side, we collected the EUGasSC dataset, which provides the daily country- and sector-specific gas supply data (Zhou et al., 2023). For the analysis of intra-EU gas transmission, we gathered the daily natural gas transmission (pipeline) and import data (both pipeline and LNG imports) for the EU27 (27 EU member countries) and UK (hereafter EU27&UK) from ENTSOG (ENTSOG, 2023), and we used EUGasSC for specifying the supply sources.

Figure 1Study workflow and conceptual framework of this study. The workflow of this study includes the following: input datasets; a supply–storage–consumption model; sector-specific consumption change attribution models; and three daily output datasets for the EU gas landscape on supply, transmission, and impacts. The supply–storage–consumption model has been described in our previous work (Zhou et al., 2023).

The ERA5-Land temperature (Hersbach et al., 2023) was collected and used to fit the empirical temperature–gas consumption (TGC) curves to estimate the gas consumption changes in the heating sector (Zhou et al., 2023) (Ciais et al., 2022). The country-based daily power generation data with specified energy sources, including gas, coal, oil, nuclear, wind, solar, hydro, and other renewables, were collected from the Carbon Monitor power dataset (Zhu et al., 2023).

The Dutch Title Transfer Facility (TTF) natural gas prices from 2019 to 2024 were collected and used as the overall natural gas price index in EU27&UK (Dutch TTF Natural Gas Futures, 2023). The household energy price index (HEPI) and the gas and electricity prices in the capital cities of EU27&UK were used for the analysis of economic impacts on household gas consumption (Household Energy Price Index, 2023).

2.2 Periods of analysis

The “winter” in this study refers to the major heating months that are associated with an elevated risk due to the energy shortage. Therefore, “winter” is defined to include the months of November, December, January, February, and March. These months use gas intensively as a major heating fuel (contributing from 54.3 % to 58.8 % of annual gas consumption) in the EU countries (Zhou et al., 2023). Accordingly, we define the post-invasion winters as November 2022 to March 2023 for the winter of 2022–2023 and from November 2023 to March 2024 for the winter of 2023–2024. For comparative analysis, we refer to the three pre-invasion winters of 2019–2020, 2020–2021, and 2021–2022 using the same seasonal time frame.

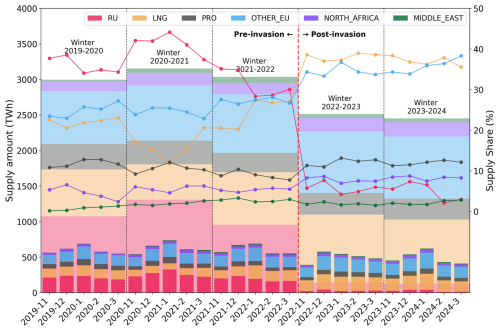

However, our study encompasses an annual perspective for analyzing the net intra-EU gas transmission. Intra-EU gas transmission in the non-heating seasons can also be important, as it may indicate variations and redistributions of gas storage within the EU (Zhou et al., 2023). Therefore, the pre-invasion period is defined as spanning from 1 April 2019 to 31 March 2022 (3 years), whereas the post-invasion period is defined as spanning from 1 April 2022 to 31 March 2024 (as illustrated in Fig. 3).

2.3 EU gas supply (EUGasSC)

For the supply side, we updated our EU natural gas dataset, EUGasSC, extending its coverage until 31 March 2024. The EUGasSC dataset has been described in our previous work (Zhou et al., 2023) and briefly introduced in the Supplement. The EUGasSC dataset provides the daily country- and sector-specific gas supply based on a mass flow balance simulation model. We then estimated changes in gas supply sources, including Russian imports, LNG imports, other pipeline imports, and EU local production based on the EUGasSC dataset. We observed a supply shortfall, the “Russian gas gap”, for post-invasion winters due to the inability to boost non-Russian gas supplies to offset the reduction in Russian gas supply. However, this gap in gas supply did not necessarily translate into a “shortage”. This supply–consumption dynamic analysis will be discussed below in Sect. 2.5.

Note that the gas supply discussed in this paper refers to the original supply source estimated in the EUGasSC dataset (see Sect. 2). For example, Germany may receive LNG gas supplies even though there are no LNG terminals in Germany before December 2022 (Waldholz et al., 2023).

2.4 Intra-EU gas transmission (EUGasNet)

To understand the changes in the intra-EU gas transmission in response to the energy crisis, we analyzed the net flow changes in the gas transmission network between the pre-invasion and post-invasion periods. To perform the net flow change analysis, we first constructed the gas transmission network graphs by integrating the physical flows, import volumes from ENTSOG, and supply sources from EUGasSC for both pre-invasion and post-invasion periods (Fig. S7b and c). Then, we accessed the bidirectional flow differences between the annual average transmission values of the pre- and post-invasion periods (Fig. S7a). Finally, we computed the net flow changes by accumulating the bidirectional flow differences. The detailed equations are presented in the Supplement.

This net flow change analysis allows us to understand the shifts in significance of both countries (nodes) and their interconnections (edges) in the intra-EU gas transmission network, as shown in Fig. 3. The nodes are color-coded to represent countries experiencing either an increase (in green) or a decrease (in red) in outgoing gas transmission relative to the pre-invasion period. The direction and net flow change (edges between countries) are only meaningful if analyzed together. For example, a positive edge connected from France to Germany indicates an increased net flow from France to Germany relative to the pre-invasion period (Fig. S8), and this is equivalent to a negative edge from Germany to France. The edge directions in our analysis (Fig. 3) are defined based on the flow patterns observed in the pre-invasion network. Therefore, the red edges in Fig. 3 indicate reversed transmission directions between the two countries during the post-invasion periods.

2.5 Consumption changes (EUGasImpact)

The EU27&UK responded to the “Russian gas gap” during the post-invasion winters by diversifying gas supplies, conserving usage, and reducing structural gas dependency. To further understand those dynamics and their impacts, we developed consumption reduction attribution models for the residential heating, power, and industrial sectors (Fig. 1). EUGasImpact is then constructed based on the output of these reduction attribution models at a daily resolution. The detailed model equations for all of the sectors discussed below are presented in the Supplement.

2.5.1 Residential heating sector

In the residential heating sector, we assess the impact of heating behavioral changes and climate change based on the behavior–climate attribution model (Fig. 1). This approach utilized the empirical temperature–gas consumption (TGC) curves, which illustrate how heating consumption varies with changes in ambient temperature (Zhou et al., 2023; Mittakola et al., 2024). We used TGC curves instead of heating degree day (HDD) models, which are widely used in energy modeling, because TGC curves not only effectively model gas consumption during winter but also capture shifts in heating behavior between pre- and post-invasion winters. Unlike HDD models, which rely on a fixed base temperature, TGC curves account for changes in heating patterns, reflecting the observed reduction in heating demand at the same ambient temperatures during the energy crisis, as shown in Fig. S9. The gas consumption change due to the behavioral shifts can be estimated by calculating the differences in consumptions at post-invasion temperatures using both pre-invasion and post-invasion TGC curves. Similarly, gas consumption changes due to temperature variations can be estimated by computing the differences in consumption under pre-invasion and post-invasion temperatures using the post-invasion TGC curves.

2.5.2 Power sector

In the power sector, we assess if the reduction in gas supply for electricity generation can be offset by alternative sources (if they exist) or if it could potentially lead to a net decrease in electricity supply based on the explainable-reduction attribution model (Fig. 1). We assume that any reduction in gas-powered electricity could be compensated for by increased electricity generation from coal, oil, nuclear, wind, solar, hydro, and other forms. Conversely, an inability to fill the reduction in gas-powered electricity might suggest a potential shortage in the overall electricity supply. To better understand the substitution of renewable energy, we analyze the Pearson correlation coefficient (r) between the increase in renewable power generation and the reduction in gas-powered electricity, with statistical significance set at p<0.05. To smooth out weekly variations, we utilized 7 d aggregated data for day-to-day comparisons of all energy sources during both the pre- and post-invasion winters.

2.5.3 Industrial sector

In the industrial sector, gas consumption can be differentiated between gas consumption for energy use, such as heating and electricity generation, and non-energy use, like chemical feedstocks or raw materials (Eurostat, 2023b; United Nations Statistics Division, 2023). Gas consumption reduction resulting from the adoption of heat pumps is unlikely to negatively impact industrial production, whereas reductions in non-energy gas use may indicate a decline in industrial output (Castellano and Varela, 2023; McWilliams et al., 2023).

Like the power sector, we evaluate the potential impact of reduced gas consumption on industrial production using the explainable-reduction attribution model (Fig. 1) and 7 d aggregated comparisons. We assume that any increase in electricity generation is primarily due to heightened heat pump usage in industry, resulting in lower gas consumption for energy use. In the industrial sector, we examined whether the increase in electricity generation could offset the reduction in industrial gas consumption for heating (electricity-to-gas comparison). As electricity and gas are not directly interchangeable, we applied a gas-to-electricity conversion efficiency to estimate the potential replacement effect. A decrease in industrial gas consumption is unlikely to negatively affect industrial production if the increase in electricity generation (if present) is sufficient to compensate for the reduced gas use, considering a specific gas-to-electricity conversion efficiency (concept illustrated in Fig. S16). Our assumption and analysis might overestimate the impact of gas shortages on industrial production (see Sect. 3).

In the residential heating sector, uncertainties are relatively low, as TGC curves can effectively capture the gas consumption based on temperature (; Fig. S9). The estimated consumption changes () account for 94±13 % of the actual changes (consumptionpre_date−consumptionpost_date). This low model uncertainty also underpins the precise predictions of gas conservation in our previous study, with only a slight overestimation of 5 % (Fig. 6, right panel) (Zhou et al., 2023). All values expressed as “±” in this paper represent standard deviations (SDs). In this study, we report values with three significant figures when they are directly calculated from raw data, whereas values derived from modeling outputs are rounded to two significant figures to better reflect their associated uncertainties.

In the power and industrial sectors, our attribution model assumed constant total power generation volumes and electricity demands during the pre- and post-invasion winters. The differences in total power generation between pre- and post-invasion winters were relatively small ( %) across the EU27&UK. However, assuming unchanged electricity demand overlooks demand variations driven by rising electricity prices and energy conservation measures across the EU (Askew, 2023; Hockenos, 2023). This could lead to an overestimation of “negative impacts”, as some observed reductions may stem from lower demand rather than actual supply constraints. Another limitation of our approach is that we did not account for cross-border electricity transmission within the EU, which could have played a role in balancing supply and demand at the national level. As a result, our analysis might depict the “maximum” potential negative impacts of gas reductions on the power and industrial sectors.

In the industrial sector, our simplified assumption does not account for the substitution of gas with other fossil fuels as an energy source, such as oil or coal, due to the lack of reliable data, even though these fuels were widely used by industries during the energy crisis to avoid disruptions. Additionally, many industrial processes require high temperatures that heat pumps alone cannot provide. As a result, our analysis likely overestimates the impact of the gas crisis on industrial production. However, it serves as a worst-case scenario, providing an upper-bound estimate of potential industrial production losses without considering alternative fossil fuels (e.g., oil or coal) and relying solely on electricity, which implies the additional electricity demand required for industrial electrification in the transition to greener energy sources.

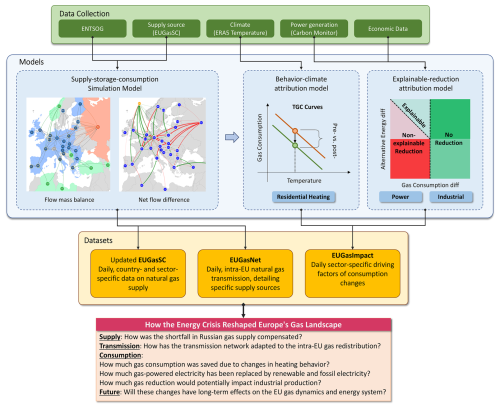

Figure 2Winter gas supply in EU27&UK from 2019 to 2024. This figure displays monthly and winter-aggregated gas supply amounts (narrow and wide bars, respectively) and their shares (line graphs) from 2019 to 2024. The gas supply sources are differentiated by color, including pipeline imports from Russia (RU), Norway and Serbia (OTHER_EU), Libya and Algeria (NORTH_AFRICA), and Türkiye and Azerbaijan (MIDDLE_EAST); LNG imports (LNG); and EU local production (EU_PRODUCTION).

4.1 Overview of gas supply and consumption

During the post-invasion winters, the natural gas supply structure to EU27&UK was profoundly reshaped (Fig. 2 and Fig. S1 in the Supplement). The share of EU gas supply from Russia, the EU's largest supplier prior to the invasion, plummeted from 36.3 % to 5.4 %, creating a shortfall of 1953.6 TW h for the two winters combined. Despite this dramatic reduction, Russia continued to provide a considerable volume of gas (257.3 TW h) to EU27&UK during the post-invasion winters through ongoing transmission to Slovakia, Lithuania, Poland, and Hungary (Table S1 in the Supplement) and via the non-winter gas storage (12.9 TW h; Fig. S4). A total of 43.5 % of the supply gap from Russia was filled in the two post-invasion winters, primarily through increased LNG imports (593.3 TW h) and by scaling up pipeline throughput from Norway and Serbia (176.9 TW h) and from Libya and Algeria (79.9 TW h). Conversely, gas supplies from Middle Eastern countries (Türkiye and Azerbaijan) and EU production decreased by 13.2 and 45.4 TW h, respectively, during the post-invasion winters. The remaining Russian gas supply gap, combined with the other supply drops, led to a substantial reduction in gas consumption during the post-invasion winters, amounting to 1162.0 TW h.

Figure 3The annual net flow changes in gas imports and the intra-EU transmission network between the pre-invasion (1 April 2019 to 31 March 2022) and post-invasion (1 April 2022 to 31 March 2024) periods. The figure illustrates changes by subtracting annual average pre-invasion values from post-invasion values. Positive values indicate increments in the post-invasion period. Circle sizes represent changes in transmission amounts by country (green for increases or red for decreases). Intra-EU transmission (edges) is color-coded (green for increase or red for decrease), with imports differentiated by import sources. Note that the flow directions are shown based on the major flow directions in the post-invasion period (see details in Sect. 2).

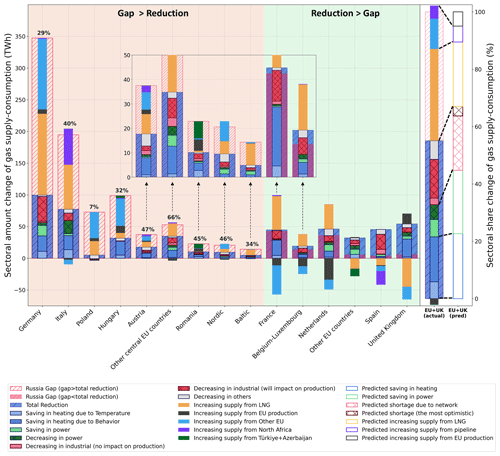

We observed a uniform decrease in gas consumption (25.5±16.0 %, where the uncertainty represents the standard deviation calculated across countries) across all EU countries regardless of their varying levels of reliance on Russian gas for the two post-invasion winters. In western EU countries (Figs. 6 and S3), where the gas supply sources remained robust, consumption reductions surpassed the decline in the Russian gas supply. This suggests that demand-side factors, such as higher gas prices or a shift away from structural dependence on gas (Zeniewski et al., 2023), were likely the primary drivers behind these reductions. In contrast, in other EU countries (Figs. 6 and S3), the gaps in Russian gas supply were greater than the reductions in consumption, indicating that supply-side constraints, such as the lack of sufficient alternative gas sources to compensate for the reduced Russian supplies, played a more significant role in their consumption reductions.

4.2 Changes in intra-EU gas transmission

Following the Russian invasion of Ukraine, significant changes occurred in intra-EU gas transmission (Figs. 3 and S7). During the pre-invasion period, the dominant gas transmission direction was from eastern central Europe toward western Europe. However, these flows experienced sharp declines in both cross-border flows (red lines in the network; Fig. 3) and total country outflow (red circles in the network; Fig. 3), primarily due to a substantial reduction in Russian gas exports to the EU (−2427.5 TW h annually). In response, gas transmission in the reverse direction increased, compensating for reduced Russian supply – for example, gas flows from Spain and France to Germany (Fig. 3, green lines and circles). Our flow change analysis (Figs. 3, S1, S7, and S8) was conducted over a 1-year duration to fully account for the transient seasonal flows related to storage changes (see Sect. 2).

Two critical pathways showing reduced net Russian gas transmission are evident in the network (Fig. 3, marked in red): (1) from Russia via Slovakia and Austria to Italy and (2) from Russia via Poland to Germany. Notably, a larger negative net flow from Poland to Germany (−520 TW h yr−1) compared to Russia to Poland (−373 TW h yr−1) appears counterintuitive. The reason for this is the shift in the initial net flow direction: prior to the invasion, gas flowed from Poland to Germany; however, during the post-invasion period, Germany reversed the flow, sending back part of its gas imports from western countries to Poland (Fig. S8). To compensate for the reduced Russian supply at the EU scale, the major LNG importing countries, including Spain, the UK, Portugal, the Netherlands, France, and Belgium and Luxembourg, significantly increased their LNG transmission-over-consumption ratio from 0.36 to 1.08 (Table S2), indicating that a greater portion of the LNG imported by these countries was redirected to others with larger gas deficits.

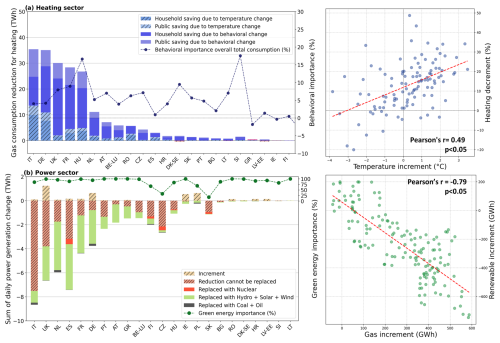

Figure 4Consumption change attributions in the residential heating (a) and power (b) sectors in EU27&UK. The gas consumption change in the heating sector is separated into behavioral change (solid color bars) and climatic change (hatched bars). The daily gas-powered electricity generation change is separated into the replaceable reduction (solid color bars), the non-replaceable reduction (red hatched bars), and the increment (beige hatched bars). The green-energy importance (%) is the share of green energy in the substituted gas-powered electricity. The correlation between the temperature increment and heating consumption reduction is shown in the right panel of subfigure (a). The correlation between the gas-powered electricity increment and the renewable power increment is shown in the right panel of subfigure (b).

4.3 Consumption reductions and attributions

The sectoral gas consumption reductions per winter are ranked in decreasing order as follows: residential sector (208.5 TW h, accounting for 14.1 % of the sector) >industrial sector (153.3 TW h, 27.5 % of the sector) > power sector (108.6 TW h, 19.5 % of the sector). However, these reductions in consumption do not necessarily equate to gas shortages in EU countries, as various responses can either reduce the gas demand or structural gas dependency (Kardaś, 2023; Castellano and Varela, 2023; IEA, 2023a). Based on our reduction attribution models (Figs. 4 and 5), we attributed the gas consumption reductions to the following factors: (1) behavioral/structural change (44 %), which includes decreased household heating consumption (29 %), increased electricity supply from alternative energy sources (coal, nuclear, wind, solar, and hydro, 11 %), and the adoption of heat pumps in the industry (4 %); (2) gas shortage (34 %), including declines in electricity generation (9 %) and industrial production (25 %); and (3) other factors (22 %), such as reduced heating demand due to warmer temperatures (11 %) and changes in unmodeled consumptions (11 %).

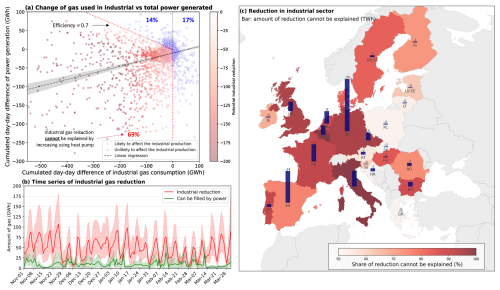

Figure 5Analysis of potential impact on industrial production. The figure panels show the following: (a) the explainable-reduction attribution model with daily comparisons of gas consumption in industrial and total electricity generation, (b) time series of industrial gas reduction and reduction that can be filled with electricity generation, and (c) the amount (bar) and proportion (choropleth) of reductions that potentially impact industrial production. The color bands in panel (b) represent the 95 % CI (confidence interval) across countries. The R2 value of the linear regression is 0.38 with a p value < 0.01.

4.3.1 Residential heating sector

We first examined the consumption reduction in the residential heating sector, as gas is mainly used for heating (46.2±18.0 % of total consumption for the post-invasion periods). Our findings reveal that, in the post-invasion winters, the majority of EU27&UK countries reduced their consumption with respect to both household and public heating, with decreases ranging from −0.5 % to −59.3 % compared with pre-invasion winters; however, exceptions to this trend were Poland and Finland, with increased consumptions. Italy experienced the largest absolute consumption reduction in the heating sector (35.6 TW h, accounting for 16.7 % of its consumption), followed by Germany (35.3 TW h, −13.6 %), the UK (30.4 TW h, −11.2 %), France (28.7 TW h, −16.7 %), and Hungary (26.8 TW h, −27.6 %). Although warmer countries could have larger reduction potentials in the residential sector, we did not find a significant correlation between heating consumption reduction and mean winter temperature (p=0.24; Fig. S10).

Conversely, we discovered that reductions in gas consumption within the residential heating sector were positively correlated with temperature anomalies (Pearson's r=0.49, p<0.05; Fig. 4a). To explore the impact of warmer temperature anomalies, the average day-to-day temperature difference between pre- and post-invasion winters, we developed a behavior–climate attribution model using TGC curves that attribute consumption reductions to either behavioral changes or temperature variations (see Sect. 2). We found lower heating consumptions for the same temperature (flatter slope of TGC diagrams) and a lower heating inception temperature (smaller intercepts of TGC diagrams) during the post-invasion winters. The consumption changes in the residential sector were primarily attributed to behavioral change (73 %; Fig. 4a), even though warmer post-invasion winter conditions (see Table S5 for temperature comparison) have been extensively reported to mitigate the impact of gas supply reductions in the EU (Prince, 2023; McWilliams et al., 2023). Those significant behavioral saving changes can be the potential response to intentional reductions due to high energy prices, government campaigns, or structural shifts away from fossil gas use for heating with heating pumps (McWilliams et al., 2023; Elliott, 2023).

4.3.2 Power sector

During the post-invasion winters, all EU27&UK countries decreased their reliance on gas-powered electricity, with reductions ranging from 15.9 % to 66.5 % compared to pre-invasion levels. To explore whether these reductions might lead to an energy shortage (net power generation decline), we compared the mix of electricity generation sources for the pre- and post-invasion periods based on an explainable-reduction attribution model, which assesses whether the decrease in gas-powered electricity generation could be replaced by other energy sources (see Sect. 2).

Our analysis reveals that, on average, 35.0±22.9 % of the days during the post-invasion winters in the EU27&UK experienced a net reduction in electricity generation due to decreased gas consumption in the power sector. These reductions accounted for 57 % of the total electricity generation decline during the post-invasion winters (35.2 TW h per winter). In particular, Italy experienced the largest and longest duration of electricity generation drop caused by gas reductions (−7.5 TW h and 77.2 % of winter days), followed by the UK (−3.8 TW h and 58.9 %), and the Netherlands (−1.7 TW h and 58.3 %), as depicted in Fig. 4b.

Following the energy structural change in the power generation between the pre-invasion and post-invasion periods (Figs. S12 and S13), we estimate that 80±48 % of the gas reduction in the power sector was compensated for by alternative power sources (Fig. 4b). Among these substitutes, renewables, including wind, solar, and hydropower, contributed the majority of that substitution at 80 % ± 22 %, and their increases were always strongly correlated with the deficits of gas-powered electricity (Pearson's , p<0.05; Figs. 4b and S15). Countries with the highest share of renewable-power substitution included Spain (9.2 TW h), followed by the Netherlands (7.2 TW h) and France (6.6 TW h). Substitution by oil and coal contributed only 10±13 %, while nuclear power contributed only a small proportion of 5 % (Fig. 4b), as French reactors had an extremely low availability.

While cross-border electricity imports could theoretically mitigate some gas-related electricity shortages, their role was limited during the crisis due to widespread power generation deficits across most EU countries (Fig. S14). However, Spain played a crucial role by significantly increasing renewable electricity generation in the first winter and reducing its gas consumption in the second winter, allowing it to support regional energy stability through both electricity exports and LNG redistribution (Fig. 3).

Compared to our initial predictions about how the shortfall in Russian gas would be addressed (Fig. 6, right panel), the power sector exhibited the largest discrepancy. We had largely overestimated European gas-substitution capacity in power generation, as we did not anticipate the shortfall of nuclear and hydropower in France (Fig. S14) (EDF France, 2023; Castellano and Varela, 2023).

Figure 6The gas supply–consumption pattern changes compared between post-invasion and pre-invasion winters in the EU27&UK. The differences are calculated by subtracting the winter average of pre-invasion winters from post-invasion winters. Wide bars (left panel) represent total gas consumption reduction (blue hatching) and Russian supply reduction (red hatching). Narrow bars illustrate supply (solid color, no borders) and consumption (solid color, borders) attributions of these reductions. Bars with crosses indicate consumption reductions potentially causing negative impacts in the power or industrial sectors. The top numbers denote the percentage of the gap absorbed within the region. The left panel shows the aggregated values and comparisons between our previous estimations. “Baltic” includes Estonia, Latvia, and Lithuania; “Nordic” includes Denmark, Sweden, and Finland; “Other central EU countries” include Slovakia, Slovenia, Czechia, and Croatia; and “Other EU countries” include Ireland, Bulgaria, and Portugal.

4.3.3 Industrial sector

We lastly looked at adjustments to industrial production, a sector particularly sensitive to supply-side energy shocks or high gas prices. All EU27&UK countries reduced their industrial gas consumption during the post-invasion winters by an average of 26.3±14.6 %. Germany saw the largest reduction per winter (41.0 TW h), contributing 25.1 % of the total reduction across EU27&UK, followed by Spain (31.6 TW h), France (14.2 TW h), and Italy (12.3 TW h).

The reduction in industrial gas consumption, both for energy and raw material uses, can lead to a decline in industrial output (Eurostat, 2023b; United Nations Statistics Division, 2023). However, the industrial gas consumption reduction in energy use can also be associated with a structural adjustment to heating techniques, such as the adoption of heat pumps (see Sect. 2 and Fig. S16), which were not expected to negatively impact industrial production (McWilliams et al., 2023; Castellano and Varela, 2023).

Using a gas-to-electricity conversion efficiency of 0.7, our reduction attribution model indicates that, on 70 % of the post-invasion winter days (Fig. 5a and b), the reductions in industrial gas consumption cannot be explained by the increases in total electricity generation, suggesting that decreased industrial production was likely caused by gas consumption reductions. Consequently, our results show that, across the EU27&UK, 5.7±9.3 TW h of the total industrial gas reduction (76±27 %) might have translated into a lower industrial production (Fig. 5c).

Although the actual impact on the industrial sector might be overestimated due to our assumption of no fuel-switching to fossil fuels, our upper-bound analysis highlights the significant industrial impact for EU countries, which in turn implies the substantial electricity demand required if the EU transitions toward industrial electrification to replace natural gas and other fossil fuels. While industrial heat pumps provide viable pathways for reducing reliance on fossil fuels, the large electricity demand suggested by our study would necessitate a significant expansion of clean electricity generation and grid capacity to further ensure the energy security in the EU. The feasibility of this transition depends on the EU's ability to scale up renewable energy sources while reinforcing grid infrastructure to support increased industrial electricity consumption.

5.1 LNG is a structural alternative to Russian gas

During the post-invasion winters, the most notable development was the significant increase in LNG imports into the EU27&UK, which surged from 20.7 % to 37.5 % of the total gas supply. EU countries are actively expanding their LNG import capacities by an additional 13 % of the current capacity in the near term (Table S3), positioning LNG as a structural alternative to Russian pipeline gas. However, the reliability of global LNG supply to EU27&UK remains uncertain. In 2022, the major global LNG supply increment came from the USA, accounting for 142 TW h (Global liquefied natural gas trade volumes set a new record in 2022, 2023) (Australia exports record LNG in 2022: Sharma, 2023), which was still insufficient to meet Europe's increased winter LNG demands. Our previous forecasts (Fig. 6, right panel) underestimated the importance of additional LNG supply in mitigating the gas crisis, as we assumed constant global LNG demand. Europe, therefore, may have benefited from substantial reductions in Chinese LNG demand in 2022 (202 TW h) due to zero COVID-19 measures and renewed energy production from coal (IEA, 2023b; US EIA, 2023a, b; Castellano and Varela, 2023). In addition, despite the geopolitical tensions, a substantial volume of LNG imports continued from Russia (Pécout, 2023).

Continuing and long-term reliance on LNG imports may pose considerable economic and climate risks for Europe. The cost of gas supplied via LNG is notably higher when compared to pipeline gas, primarily due to the increased expenses associated with transportation, liquefaction, and regasification (Shah, 2023). These costs can translate into elevated end-user gas prices, as reflected in the doubling of household gas and energy costs (Fig. S6). Despite the large greenhouse gas emissions associated with LNG liquefaction, our estimations suggest that, solely during transportation, LNG tankers might produce 2.4 times the amount of CO2-equivalent emissions compared to pipelines when supplying the same amount of gas, even after accounting for a potential leakage rate of 1.4 % from Russian pipeline transportation (see the Supplement; Lelieveld et al., 2005; Abrahams et al., 2015).

Dutch TTF natural gas prices (Fig. S5) exhibited a sharp rise in the winter of 2022–2023 in response to the profound supply pattern changes following the Russian invasion of Ukraine, peaking at 3 times pre-invasion levels. Nevertheless, the TTF price returned to pre-invasion levels for the second post-invasion winter (winter of 2023–2024), suggesting a potential alleviation of the gas crisis through existing gas supply–consumption dynamics.

5.2 Norway and northern Africa are stabilizers of gas supply

The increase in gas supply from Norway and northern Africa to Europe during the post-invasion winters was much smaller than the LNG increment, contributing only 28.9 % of the total LNG increase. However, their contributions were crucial as “stabilizers” in balancing the gas supply shortages within the EU27&UK by redirecting their exports to those countries that experienced larger reductions in Russian supply and had infrastructural constraints in accessing extra LNG supply. For instance, Norway redirected its gas exports from France and the Netherlands to Germany, while northern African exporters redirected their gas exports from Spain to Italy, as shown in Fig. 3. Notably, in Germany, the share of Norwegian gas in the total supply jumped from 33.5 % to 60.4 %, effectively replacing Russian gas as the primary source. Similarly, Italy increased its reliance on northern African gas from 22.7 % to 44.1 % of its total supply.

5.3 Germany has reshaped the intra-EU gas transmission

To address the gas shortage in Germany, significant adjustments to the intra-EU gas transmission network were observed, involving a net reversal of the historical east-to-west flow direction (Fig. 3). Substantial increments of intra-country transmission were seen from countries that are equipped with large, preexisting terminals, e.g., Belgium and the Netherlands, to Germany (Fig. 3). New transmission pathways developed to service Germany, indicating close cooperation among European member states, as shown in Fig. 3: (1) transmission from France to Germany came online in October 2022 (210 TW h) (Zhou et al., 2023) by resolving the different gas odorization systems between the two countries, (2) Denmark and Sweden reduced their reliance on German transmission by directly importing gas from Norway, and (3) Germany began its own direct LNG imports in December 2022 (14 TW h) via the newly developed LNG terminals (Waldholz et al., 2023). The resolution of gas odorization differences enabled direct France-to-Germany gas transmission, overcoming a long-standing technical barrier (Zhou et al., 2023), although a significant bypass route through France and Belgium to Germany remains visible in Fig. 3, highlighting ongoing efforts toward full network integration. While the changes in the gas transmission network may not be permanent – pending the establishment of German LNG terminals or a reduction in its structural dependency on gas – the overall shift in intra-EU gas transmission from eastern to western Europe, previously dominated by Russian supplies, has been structurally reversed.

5.4 Behavioral heating reduction is economy-sensitive

In residential heating, consumption reductions were primarily driven by behavioral changes, as previously discussed. The declines in isothermic gas heating consumption during the post-invasion winters (flatter slopes of TGC in Fig. S9) can be associated with the concurrent, rapid surge in heat pump sales within the EU and their increasing adoption in household heating (European Heat Pump Association, 2023). The heat pumps, despite their superior heating efficiency, may not necessarily lead to lower overall residential heating costs. This is partly due to higher electricity prices caused by increased demand from both residential and industrial sectors using heat pumps (Fig. S6a), which can offset the cost benefits of transitioning from gas heaters. Additionally, lower start heating temperatures (Fig. S9) were observed, corresponding to the base temperature in HDD models, indicating that the reduced comfort levels for heating inception and were likely driven by rising gas and energy prices (Fig. S6). Therefore, further shifts away from gas to heat pumps in residential heating are sensitive to economic factors and depend on the dynamics between gas and electricity supply and pricing.

5.5 Structural independence from gas-powered electricity

A substantial growth of renewables was found in the post-invasion winters, and it dominated the substitution of gas-powered electricity (Fig. 4b). In the initial post-invasion period, fossil fuel substitution remained significant, particularly in Germany and Italy (Fig. S14a), accounting for 48 % of the substitution in these two countries. However, by the second post-invasion winter (winter 2023–2024), renewable energy took the lead across all EU27&UK countries, with renewables accounting for an increased substitution rate of 114 %, suggesting that a structural shift from gas-powered electricity has been successfully developing in EU27&UK.

On the other hand, the contribution of nuclear energy to this substitution was considerably lower than expected due to the maintenance of the French nuclear reactor fleet and Germany's phaseout of nuclear power (Fig. S14). Nevertheless, nuclear energy might regain strategic importance in offsetting gas-fueled power generation in the future, particularly as some French reactors come back online and the demand for electricity increases due to widespread heat pump installations.

The expansion of electricity production through alternative energy sources, such as green electricity and nuclear power, offers a dual benefit. It not only substitutes for gas-fueled power generation but also supports gas reduction in the residential heating and industrial sectors through the adoption of heat pumps. Achieving full structural independence from gas still presents challenges in the near term due to existing electricity infrastructure constraints, transitioning toward green electricity, and nuclear power maintenance issues.

5.6 Pathway to EU energy security

Our analysis of the structural and temporary shifts in European gas and energy supply and consumption patterns during the post-invasion winters underscores the region's institutional and infrastructural resilience to this energy crisis. We found that energy security has been and will continue to be enhanced by (1) increasing LNG imports to diversify gas supply sources, (2) strengthening both international and intra-EU cooperation, and (3) systematically reducing gas dependency by decreasing residential gas heating and expanding the use of renewable and nuclear power.

While addressing existing challenges on the pathway to EU energy security, such as the dynamics of the global LNG market, EU gas infrastructure capacities, and the potential impact on climate change, we also identify key areas that require further attention (European Parliament, 2023): (1) systematic substitution of heat fuel from gas to electricity will require systematic increases in power supply and generation capacity; (2) in turn, rising electrical demand will need to be met with expansions in power generation, preferably through renewable energy sources; (3) effective energy redistribution, including both gas and electricity, among EU countries will call for a unified strategy that includes greater integration and enhancement of both physical and institutional infrastructures.

We updated one dataset (EUGasSC) and published two new datasets (EUGasNet and EUGasImpact) as CSV files, and they are hosted on the Zenodo platform: https://doi.org/10.5281/zenodo.11175364 (Zhou et al., 2024). The EUGasSC and EUGasNet datasets are available from 2016, whereas the EUGasImpact dataset is only available for the two post-invasion winters. The datasets are openly accessible and are licensed under a Creative Commons Attribution 4.0 International license. The column headings of the data dictionary files and the unit of each variable are listed in Table S4.

Our datasets provide daily updates on gas supply, storage, transmission, and consumption, providing sector- and country-specific data on the European gas landscape. Our datasets also capture the pattern changes after the Russian invasion of Ukraine, as well as the driving factors of those changes. These datasets can serve as either input or reference datasets for further research across various fields, including gas/energy modeling, carbon emission studies, climate change impacts, geopolitical policy discussions, and international gas/energy market analysis. By offering multidimensional insights, our data facilitate a comprehensive understanding of the dynamics within the EU gas landscape and contribute to outlining pathways toward EU energy security. Chuanlong Zhou, who collected the data and performed the analysis, and Philippe Ciais, who is an expert on the background of this study, are at the disposal of researchers wishing to reuse the datasets.

We updated one dataset (EUGasSC) and introduced two new datasets (EUGasNet and EUGasImpact) for the EU27&UK at daily resolutions: (1) the EUGasSC dataset, describing the sector- and country-based daily natural gas supply, storage, and consumption; (2) the EUGasNet dataset, describing the intra-EU gas transmission with specified supply source data; and (3) the EUGasImpact dataset, describing the sector-specific gas consumption changes between the pre- and post-invasion winters, combined with the contributions of driving factors. Together, these datasets offer multidimensional insights into the dynamics within the EU gas landscape and can be valuable to future research on various fields and topics, such as energy modeling, carbon emission analysis, climate change research, and policy discussions.

Using these datasets, we analyzed the pattern changes in the EU gas landscape between the pre- and post-invasion winters. We show how the EU27&UK adapted their gas supply, transmission, and consumption patterns in response to the gas crisis. We quantified the contribution of driving factors in the residential heating, power, and industrial sectors. Our findings indicate significant changes and growing structural independence from gas during the post-invasion winters: (1) total gas consumption decreased by 19.0 % due to the sudden loss of Russian gas; (2) LNG emerged as the largest gas supply source, accounting for 37.5 % of the total gas supply; (3) intra-EU gas transmission adjustments focused primarily on addressing the significant shortfall in Germany; (4) behavioral changes in household heating individually contributed most to consumption reduction (29 %); (5) renewable electricity dominated the substitution of gas-powered electricity (93 %); and (6) relatively large consumption reductions can be associated with declines in industrial production and power shortage (34 %).

The supplement related to this article is available online at https://doi.org/10.5194/essd-17-3431-2025-supplement.

CZ: conceptualization, data curation, methodology, validation, writing – original draft preparation, and writing – review and editing. BZ: data curation, validation, and writing – review and editing. AH: conceptualization and writing – review and editing. SJD: conceptualization and writing – review and editing. ZL: conceptualization and writing – review and editing. SB: writing – review and editing. SBA: data curation and validation. PC: supervision, conceptualization, and writing – review and editing.

The contact author has declared that none of the authors has any competing interests.

Publisher's note: Copernicus Publications remains neutral with regard to jurisdictional claims made in the text, published maps, institutional affiliations, or any other geographical representation in this paper. While Copernicus Publications makes every effort to include appropriate place names, the final responsibility lies with the authors.

This paper was edited by Martina Stockhause and reviewed by three anonymous referees.

Abnett, K.: Europe experienced second-warmest winter on record, Reuters, https://www.reuters.com/business/environment/europe-experienced-second-warmest-winter-record-2023-03-08/ (last access: 9 March 2023), 2023.

Abrahams, L. S., Samaras, C., Griffin, W. M., and Matthews, H. S.: Life cycle greenhouse gas emissions from U.S. liquefied natural gas exports: Implications for end uses, Environ. Sci. Technol., 49, 3237–3245, https://doi.org/10.1021/es505617p, 2015.

Askew, J.: What measures are European countries taking to conserve energy?, https://www.euronews.com/my-europe/2022/10/21/what-measures-are-european-countries-taking-to-conserve-energy (last access: 4 July 2023), 2023.

Castellano, C. and Varela, C.: Europe | Natural Gas: Toward Winter 2024, https://www.bbvaresearch.com/en/publicaciones/europe-natural-gas-toward-winter-2024/ (last access: 3 July 2023), 2023.

Ciais, P., Bréon, F.-M., Dellaert, S., Wang, Y., Tanaka, K., Gurriaran, L., Françoise, Y., Davis, S. J., Hong, C., Penuelas, J., Janssens, I., Obersteiner, M., Deng, Z., and Liu, Z.: Impact of Lockdowns and Winter Temperatures on Natural Gas Consumption in Europe, Earth's Future, 10, e2021EF002250, https://doi.org/10.1029/2021EF002250, 2022.

Dutch TTF Natural Gas Futures: https://www.theice.com/products/27996665/Dutch-TTF-Gas-Futures/data?marketId=5600523 (last access: 2 August 2023), 2023.

EDF France: List of outages and messages, https://www.edf.fr/en/the-edf-group/who-we-are/activities/optimisation-and-trading/list-of-outages-and-messages/list-of-outages (last access: 27 July 2023), 2023.

Elliott, S.: Denmark launches energy saving campaign; European gas supply “under pressure”, https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/electric-power/062822-denmark-launches-energy-saving-campaign-european (last access: 17 July 2023), 2023.

United Nations Statistics Division: International Recommendations for Energy Statistics (IRES), https://unstats.un.org/unsd/energystats/methodology/ires/ (last access: 24 July 2023), 2023.

ENTSOG: LNG exports for selected countries, 2015–2025, https://www.entsog.eu/sites/default/files/2021-11/ENTSOG_CAP_2021_A0_1189x841_FULL_066_FLAT.pdf (last access: 10 June 2020), 2020.

ENTSOG: https://transparency.entsog.eu/ (last access: 17 June 2023), 2023.

European Heat Pump Association: Heat Pumps in Europe – Key Facts and Figures, https://www.ehpa.org/heat-pumps-in-europe-key-facts-and-figures/ (last access: 11 September 2023), 2023.

European Parliament: Four challenges of the energy crisis for the EU's strategic autonomy, https://www.europarl.europa.eu/thinktank/en/document/EPRS_BRI(2023)747099 (last access: 8 November 2023), 2023.

Eurostat: Imports of natural gas by partner country, https://ec.europa.eu/eurostat/web/products-datasets/-/nrg_ti_ gas (last access: 24 July 2023), 2023a.

Eurostat: Supply, transformation and consumption of gas, https://ec.europa.eu/eurostat/web/products-datasets/-/nrg_cb_ gas (last access: 24 July 2023), 2023b.

Hersbach, H., Bell, B., Berrisford, P., Biavati, G., Horányi, A., Muñoz Sabater, J., Nicolas, J., Peubey, C., Radu, R., and Rozum, I.: ERA5 hourly data on single levels from 1979 to present, Copernicus climate change service (c3s) climate data store (cds) [data set], https://doi.org/10.24381/cds.adbb2d47, 2023.

Hockenos, P.: Averting Crisis, Europe Learns to Live Without Russian Energy, https://e360.yale.edu/features/europe-energy-crisis-winter-gas-coal-wind-solar-emissions (last access: 4 July 2023), 2023.

Household Energy Price Index: https://www.energypriceindex.com/ (last access: 2 August 2023), 2023.

IEA: Baseline European Union gas demand and supply in 2023 – How to Avoid Gas Shortages in the European Union in 2023 – Analysis, https://www.iea.org/reports/how-to-avoid-gas-shortages-in-the-european-union-in-2023/baseline-european-union-gas-demand-and-supply-in-2023 (last access: 26 June 2023), 2023a.

IEA: How the European Union can avoid natural gas shortages in 2023, https://www.iea.org/news/how-the-european-union-can-avoid-natural-gas-shortages-in-2023 (last access: 3 July 2023), 2023b.

Kardaś, S.: Conscious uncoupling: Europeans' Russian gas challenge in 2023, https://ecfr.eu/article/conscious-uncoupling-europeans-russian-gas-challenge-in-2023/ (last access: 4 July 2023), 2023.

Lelieveld, J., Lechtenböhmer, S., Assonov, S. S., Brenninkmeijer, C. A. M., Dienst, C., Fischedick, M., and Hanke, T.: Greenhouse gases: low methane leakage from gas pipelines, Nature, 434, 841–842, 2005.

McWilliams, B., Tagliapietra, S., Zachmann, G., and Deschuyteneer, T.: Preparing for the next winter: Europe's gas outlook for 2023, https://www.bruegel.org/policy-brief/european-union-gas-survival-plan-2023 (last access: 26 June 2023), 2023.

Mittakola, R. T., Ciais, P., and Zhou, C.: Short-to-medium range forecast of natural gas use in the United States residential buildings, J. Clean. Product., 437, 140687, https://doi.org/10.1016/j.jclepro.2024.140687, 2024.

Pécout, A.: L'Europe a augmenté ses importations de gaz russe par la mer, malgré la guerre en Ukraine, Le Monde, https://www.lemonde.fr/economie/article/2023/09/11/malgre-la-guerre-en-ukraine-l-europe-a-augmente-ses-importations-de-gaz-russe-par-la-mer_6188799_3234.html, last access: 11 September 2023.

Prince, T.: A Test Of Endurance: Europe Faces A Chilling Couple Of Years, But Russia Stands To Lose The Energy Showdown, https://www.rferl.org/a/russia-europe-energy-showdown-gas-cold-ukraine-war/32204068.html (last access: 26 June 2023), 2023.

Shah, A.: LNG vs. Pipeline Economics [Gaille Energy Blog Issue 66], https://gaillelaw.com/2018/05/16/lng-vs-pipeline-economics-gaille-energy-blog-issue-66/ (last access: 8 August 2023), 2023.

Sharma, S.: Australia Exported Record LNG, in 2022: EnergyQuest, https://www.naturalgasworld.com/australia-exported-record-lng-in-2022-energyquest-103241 (last access: 8 August 2023), 2023.

US EIA: Global liquefied natural gas trade volumes set a new record in 2022, https://www.eia.gov/todayinenergy/detail.php?id=57000 (last access: 7 August 2023), 2023a.

US EIA: China's natural gas consumption and LNG imports declined in 2022, amid zero-COVID policies, https://www.eia.gov/todayinenergy/detail.php?id=56680 (last access: 7 August 2023), 2023b.

Waldholz, R., Wehrmann, B., and Wettengel, J.: Ukraine war pushes Germany to build LNG terminals, https://www.cleanenergywire.org/factsheets/liquefied-gas-does-lng-have-place-germanys-energy-future (last access: 17 July 2023), 2023.

Zeniewski, P., Molnar, G., and Hugues, P.: Europe's energy crisis: What factors drove the record fall in natural gas demand in 2022?, https://www.iea.org/commentaries/europe-s-energy-crisis-what-factors-drove-the-record-fall-in (last access: 16 July 2023), 2023.

Zhou, C., Zhu, B., Davis, S. J., Liu, Z., Halff, A., Arous, S. B., de Almeida Rodrigues, H., and Ciais, P.: Natural gas supply from Russia derived from daily pipeline flow data and potential solutions for filling a shortage of Russian supply in the European Union (EU), Earth Syst. Sci. Data, 15, 949–961, https://doi.org/10.5194/essd-15-949-2023, 2023.

Zhu, B., Deng, Z., Song, X., Zhao, W., Huo, D., Sun, T., Ke, P., Cui, D., Lu, C., Zhong, H., Hong, C., Qiu, J., Davis, S. J., Gentine, P., Ciais, P., and Liu, Z.: CarbonMonitor-Power near-real-time monitoring of global power generation on hourly to daily scales, Sci. Data, 10, 217, https://doi.org/10.1038/s41597-023-02094-2, 2023.

Zhou, C., Zhu, B., Ciais, P., Arous, S. B., Davis, S. J., and Liu, Z.: EU27&UK gas supply-transmission-consumption structures with driving factors of consumption change, Zenodo [data set], https://doi.org/10.5281/zenodo.11175364, 2024.